Daily Archives: May 21, 2024

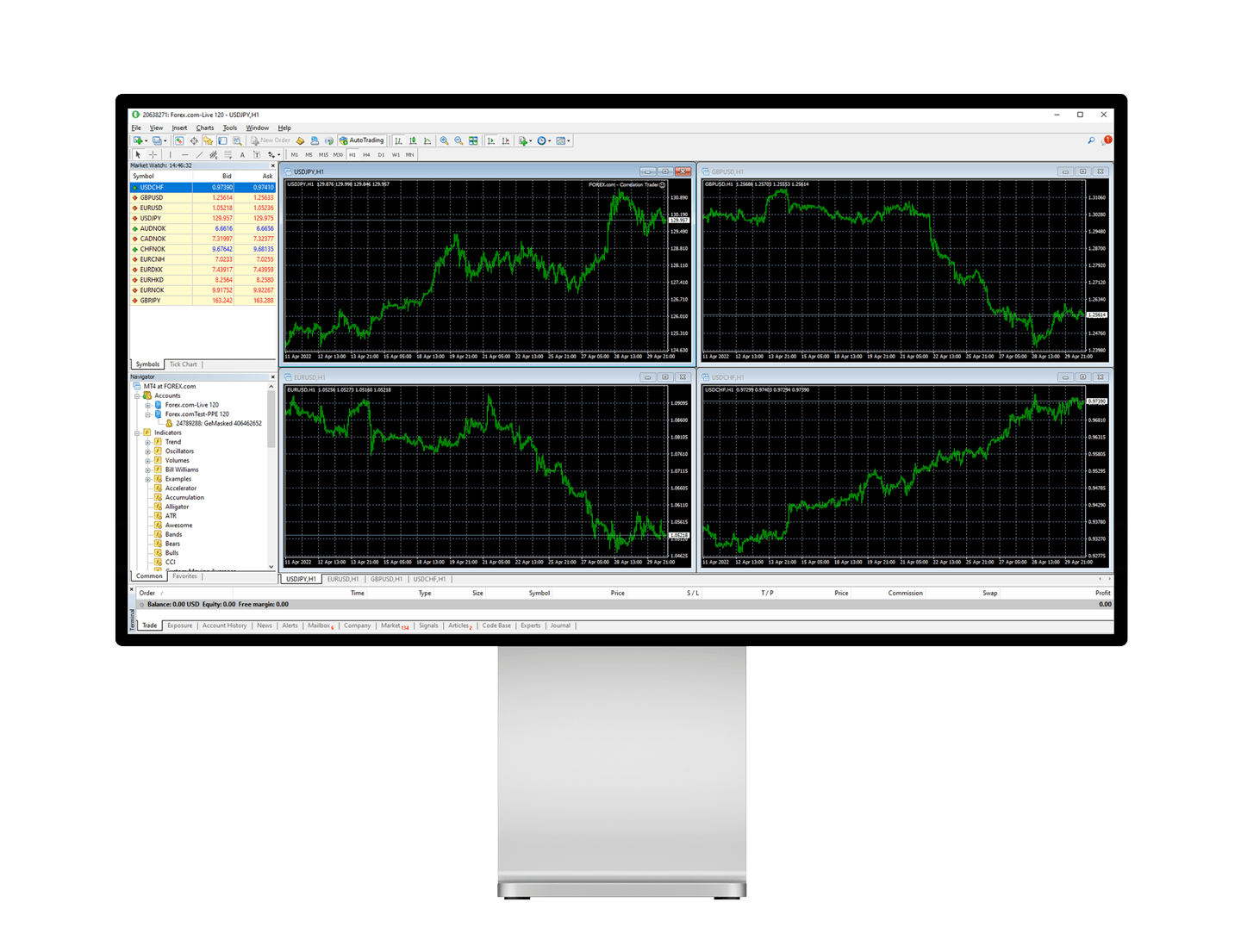

metatrader 4 for windows is a popular trading platform used by forex traders globally due to its user-friendly interface and robust functionalities. However, like any software, users may occasionally encounter issues that can disrupt their trading activities. Below are some common MT4 problems and their solutions to help you get back on track quickly.

1. Connection Issues

Symptoms

• Unable to log in

• Frequent disconnections

• Delayed data feed

Solutions

• Check Internet Connection: Ensure your internet connection is stable. Unstable connections can cause frequent disconnections.

• Server Selection: Verify you’re connected to the correct server. Sometimes, simply switching servers can resolve connection issues.

• Firewall and Antivirus Settings: Ensure your firewall or antivirus software isn’t blocking MT4. Adding MT4 to the list of allowed programs can solve this problem.

2. Platform Freezing or Crashing

Symptoms

• MT4 becomes unresponsive

• Platform crashes during operation

Solutions

• Update MT4: Ensure you’re using the latest version of the software. Updates often include bug fixes that can resolve stability issues.

• Reduce Chart Load: Having too many charts open with numerous indicators can overload MT4. Close unnecessary charts and remove non-essential indicators.

• Reinstall MT4: If issues persist, consider reinstalling the platform. This can help resolve deeper software problems.

3. Trade Execution Errors

Symptoms

• Orders not executed

• Frequent re-quotes

• “Invalid S/L or T/P” error messages

Solutions

• Check Internet Speed: Slow internet speeds can cause delays in order execution. Ensure your connection is fast and stable.

• Adjust Slippage Settings: Increase your slippage tolerance in the order settings to avoid re-quotes.

• Correct Stop-Loss and Take-Profit Levels: Ensure your stop-loss and take-profit levels are set correctly according to your broker’s requirements.

4. Indicators Not Displaying Properly

Symptoms

• Indicators not appearing on charts

• Incorrect indicator values

Solutions

• Enable DLL Imports: Some indicators require DLL imports to function correctly. Go to `Tools > Options > Expert Advisors` and enable “Allow DLL imports.”

• Check Indicator Settings: Verify the settings of the indicators. Incorrect parameters can lead to improper display.

• Reinstall Indicators: Remove and reinstall the problematic indicators to ensure they are correctly integrated into MT4.

Conclusion

While MT4 is a reliable trading platform, encountering issues is not uncommon. By understanding these common problems and their solutions, you can troubleshoot effectively and minimize downtime, ensuring a smoother trading experience. Remember, keeping your MT4 updated and maintaining a stable internet connection can prevent many of these issues from occurring in the first place. Happy trading!

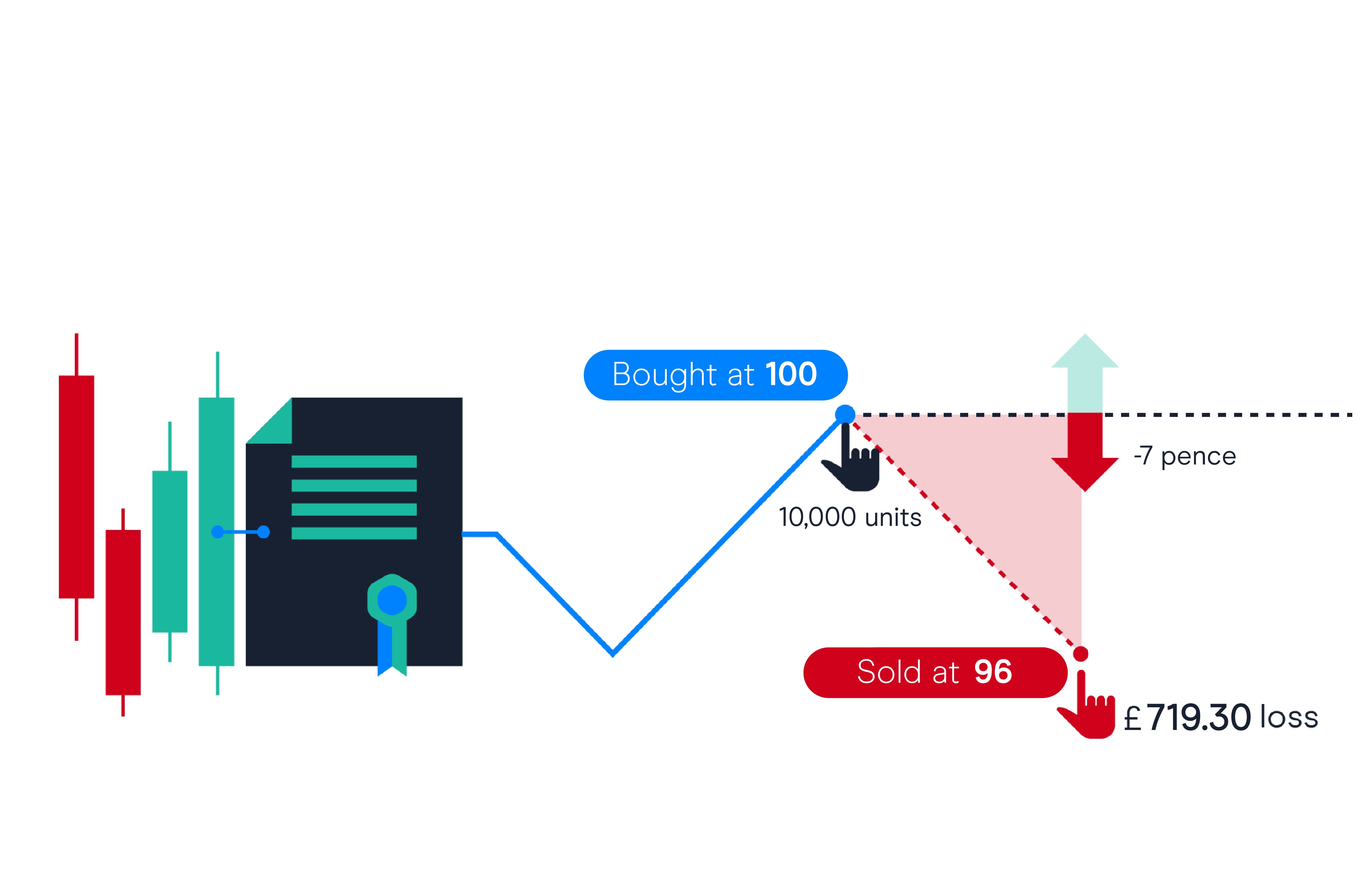

Contracts for Difference (CFDs) have gained popularity among traders due to their flexibility and accessibility to various financial markets. However, like any trading instrument, CFDs come with both risks and benefits. Here’s a closer look at the pros and cons of trading CFD how it works:

Benefits:

1. Diversification:

CFDs offer traders the ability to diversify their portfolios across different asset classes, including stocks, commodities, currencies, and indices. This diversification can help spread risk and potentially enhance overall returns.

2. Flexibility in Leverage:

CFD trading provides flexible leverage, allowing traders to control larger positions with a smaller initial investment. This can amplify profits if the trade goes in your favor. However, it’s essential to use leverage cautiously as it also increases the potential for losses.

3. Access to Global Markets:

With CFDs, traders can access global financial markets from a single trading platform. Whether you’re interested in trading U.S. stocks, European indices, or Asian currencies, CFDs provide the opportunity to participate in markets around the world.

4. Trading Opportunities in Any Market Condition:

CFDs enable traders to profit from both rising and falling markets. Whether a market is bullish or bearish, there are opportunities to generate profits through long (buy) or short (sell) positions.

Risks:

1. High Risk of Losses:

CFD trading involves a high level of risk due to leverage. While leverage can amplify profits, it also magnifies losses. Even a small adverse price movement can result in significant losses, potentially exceeding your initial investment.

2. Counterparty Risk:

When trading CFDs, you are entering into a contract with your broker. Therefore, there is counterparty risk that your broker may default on its obligations. It’s essential to choose a reputable and regulated broker to mitigate this risk.

3. Volatility and Market Risks:

Financial markets are inherently volatile, and CFDs are no exception. Price fluctuations can occur rapidly, especially during times of economic uncertainty or geopolitical instability, increasing the risk of losses for traders.

4. Overnight Financing Costs:

Holding CFD positions overnight may incur financing costs, also known as overnight fees or swaps. These costs can eat into profits, particularly for longer-term trades, and should be considered when planning your trading strategy.

In conclusion, while CFDs offer traders numerous benefits, including diversification, flexible leverage, and access to global markets, they also carry inherent risks, such as high volatility, leverage-induced losses, and counterparty risk. It’s essential for traders to understand these risks and to trade responsibly, using risk management strategies to protect their capital.