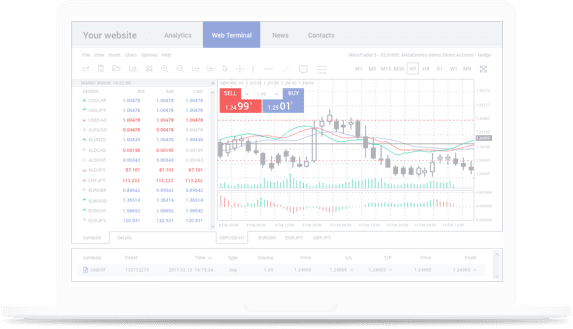

How to Automate Your Trading Using Online Trading Platforms

The world of trading has undergone a massive technological transformation. Automation is no longer a luxury—it’s quickly becoming a standard feature for online trading who want to stay ahead. By leveraging online trading platforms, automating trades has become streamlined and more accessible than ever, allowing traders to save time, reduce emotional bias, and execute strategies with precision.

But how exactly can you automate your trading? Let’s explore the steps and benefits.

What Is Automated Trading?

Automated trading uses algorithms to execute buy and sell orders based on pre-defined rules, such as price conditions, trading volume, or timing. These algorithms are designed to analyze market trends, make decisions, and execute trades faster than a human could manually.

Instead of constantly monitoring the markets, automation allows traders to set their strategies in motion and monitor overall progress. Whether you’re looking for a fully hands-off approach or partial automation, online trading platforms make it possible.

Steps to Automate Your Trading

1. Identify Your Trading Goals

Before automating your trades, it’s critical to define your objectives. Are you aiming for long-term growth, short-term profits, or risk management? Clearly outlining your goals will help you determine the rules and conditions for your automated system.

2. Choose or Create a Strategy

Automated trading isn’t guesswork—it requires a clear strategy. These strategies should include entry criteria (when to buy), exit criteria (when to sell), and risk management (limits on losses). Some platforms provide pre-built strategies, while others allow traders to build custom settings tailored to their preferences.

3. Leverage Backtesting Tools

Once you’ve set up your strategy, it’s essential to test it using historical market data. Backtesting tools evaluate how your system would have performed in the past, offering valuable insights into its effectiveness. This step helps fine-tune the strategy before it’s applied live.

4. Set Your Autopilot Features

Online trading platforms allow you to set automation features, such as stop-loss, take-profit orders, or technical indicators. Define the limits and conditions for your trades. Automation eliminates manual errors and the emotional decisions often associated with real-time market fluctuations.

5. Monitor and Adjust

Even though automated systems handle trades for you, regular monitoring is still essential. Markets can shift, and strategies might become less effective over time. Continuous optimization ensures your trading system adapts to changing conditions.

Benefits of Automating Trading

• Speed and Precision: Automated systems execute trades in milliseconds based on real-time data, reducing the risk of missed opportunities.

• Reduced Emotional Impact: Automation eliminates emotional decision-making, protecting you from rash moves during volatile market conditions.

• Consistent Strategy Execution: Algorithms stick to your rules, ensuring trades are consistent and data-driven.

• Time Efficiency: Automation frees up your time, allowing you to focus on other aspects of your portfolio or personal life.

Is Automated Trading Right for You?

While automated trading provides undeniable advantages, it’s not a one-size-fits-all solution. Beginners should start with caution, understanding the strategies and platforms before allowing algorithms to manage trades fully. Seasoned traders, on the other hand, may find automation invaluable in scaling their operations and maintaining consistent performance.