CFD Trading: Maximizing Profits and Minimizing Risks

Contracts for Difference (CFDs) have gained popularity among traders due to their flexibility and accessibility to various financial markets. However, like any trading instrument, CFDs come with both risks and benefits. Here’s a closer look at the pros and cons of trading CFD how it works:

Benefits:

1. Diversification:

CFDs offer traders the ability to diversify their portfolios across different asset classes, including stocks, commodities, currencies, and indices. This diversification can help spread risk and potentially enhance overall returns.

2. Flexibility in Leverage:

CFD trading provides flexible leverage, allowing traders to control larger positions with a smaller initial investment. This can amplify profits if the trade goes in your favor. However, it’s essential to use leverage cautiously as it also increases the potential for losses.

3. Access to Global Markets:

With CFDs, traders can access global financial markets from a single trading platform. Whether you’re interested in trading U.S. stocks, European indices, or Asian currencies, CFDs provide the opportunity to participate in markets around the world.

4. Trading Opportunities in Any Market Condition:

CFDs enable traders to profit from both rising and falling markets. Whether a market is bullish or bearish, there are opportunities to generate profits through long (buy) or short (sell) positions.

Risks:

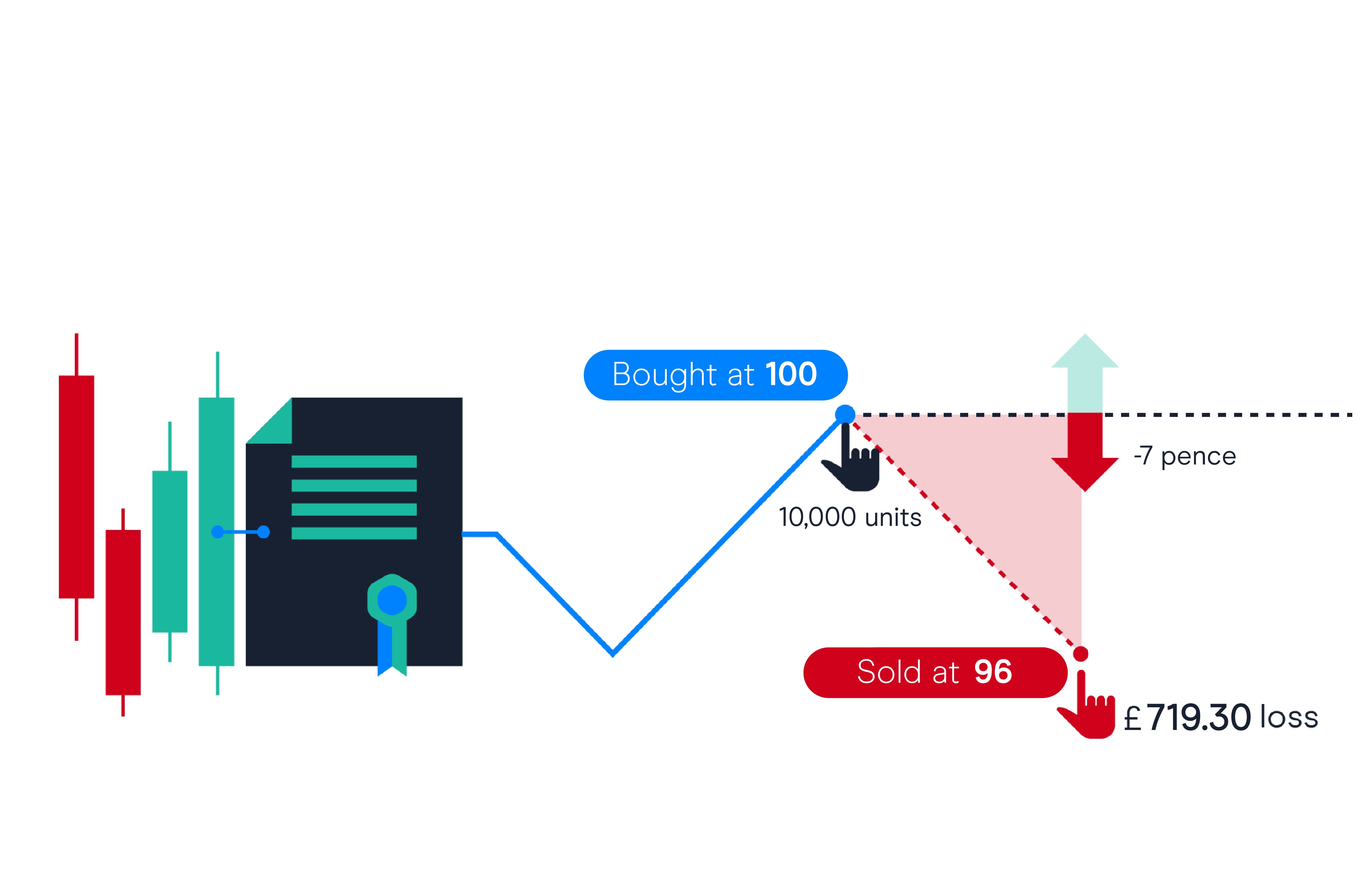

1. High Risk of Losses:

CFD trading involves a high level of risk due to leverage. While leverage can amplify profits, it also magnifies losses. Even a small adverse price movement can result in significant losses, potentially exceeding your initial investment.

2. Counterparty Risk:

When trading CFDs, you are entering into a contract with your broker. Therefore, there is counterparty risk that your broker may default on its obligations. It’s essential to choose a reputable and regulated broker to mitigate this risk.

3. Volatility and Market Risks:

Financial markets are inherently volatile, and CFDs are no exception. Price fluctuations can occur rapidly, especially during times of economic uncertainty or geopolitical instability, increasing the risk of losses for traders.

4. Overnight Financing Costs:

Holding CFD positions overnight may incur financing costs, also known as overnight fees or swaps. These costs can eat into profits, particularly for longer-term trades, and should be considered when planning your trading strategy.

In conclusion, while CFDs offer traders numerous benefits, including diversification, flexible leverage, and access to global markets, they also carry inherent risks, such as high volatility, leverage-induced losses, and counterparty risk. It’s essential for traders to understand these risks and to trade responsibly, using risk management strategies to protect their capital.