Tag Archives: cfds

Swing trading with Contracts for Difference (CFDs) is a popular strategy for traders looking to take advantage of short- to medium-term price movements in various financial markets. Unlike day trading, swing trading allows for more flexibility and doesn’t require constant monitoring of positions. Here’s all you need to know to get started with swing trading using cfds:

Understanding Swing Trading:

Swing trading involves capturing short- to medium-term gains in an asset over a period of a few days to several weeks. Traders aim to profit from ‘swings’ or price movements within a trend. CFDs, or Contracts for Difference, are financial derivatives that allow traders to speculate on price movements without owning the underlying asset.

Strategies for Swing Trading with CFDs:

Trend Following: This strategy involves identifying and following the prevailing trend. Traders aim to enter positions in the direction of the trend during pullbacks or minor retracements.

Range Trading: Traders employing this strategy identify key levels of support and resistance and aim to buy at support and sell at resistance within a trading range.

Breakout Trading: Traders look for breakouts of key levels, such as support or resistance, and enter positions when the price breaks out of these levels with high volume.

Candlestick Patterns: Swing traders often use candlestick patterns to identify potential trend reversals or continuations, such as engulfing patterns, dojis, and hammers.

Tips for Successful Swing Trading:

Risk Management: Set stop-loss orders to manage risk on each trade. Risk only a small portion of your trading capital on each trade to preserve your account.

Use Technical Analysis: Learn to use technical indicators such as moving averages, RSI, MACD, etc., to identify potential entry and exit points.

Stay Informed: Keep an eye on market news and events that could impact the assets you are trading. Economic reports, geopolitical events, and central bank announcements can all influence prices.

Practice Patience: Wait for the right setups and avoid overtrading. Not every price movement is tradable, so be patient and selective.

Keep Leverage in Check: CFDs offer flexible leverage, but it’s essential to use it wisely. High leverage can magnify both gains and losses, so trade with caution.

Maintain Discipline: Stick to your trading plan and avoid emotional decision-making. Discipline is crucial for long-term success in swing trading.

Swing trading with CFDs can offer opportunities in various markets, including stocks, forex, commodities, and indices. By employing the right strategies and risk management techniques, traders can aim to profit from short- to medium-term price movements effectively.

Contracts for Difference (CFDs) have gained popularity among traders due to their flexibility and accessibility to various financial markets. However, like any trading instrument, CFDs come with both risks and benefits. Here’s a closer look at the pros and cons of trading CFD how it works:

Benefits:

1. Diversification:

CFDs offer traders the ability to diversify their portfolios across different asset classes, including stocks, commodities, currencies, and indices. This diversification can help spread risk and potentially enhance overall returns.

2. Flexibility in Leverage:

CFD trading provides flexible leverage, allowing traders to control larger positions with a smaller initial investment. This can amplify profits if the trade goes in your favor. However, it’s essential to use leverage cautiously as it also increases the potential for losses.

3. Access to Global Markets:

With CFDs, traders can access global financial markets from a single trading platform. Whether you’re interested in trading U.S. stocks, European indices, or Asian currencies, CFDs provide the opportunity to participate in markets around the world.

4. Trading Opportunities in Any Market Condition:

CFDs enable traders to profit from both rising and falling markets. Whether a market is bullish or bearish, there are opportunities to generate profits through long (buy) or short (sell) positions.

Risks:

1. High Risk of Losses:

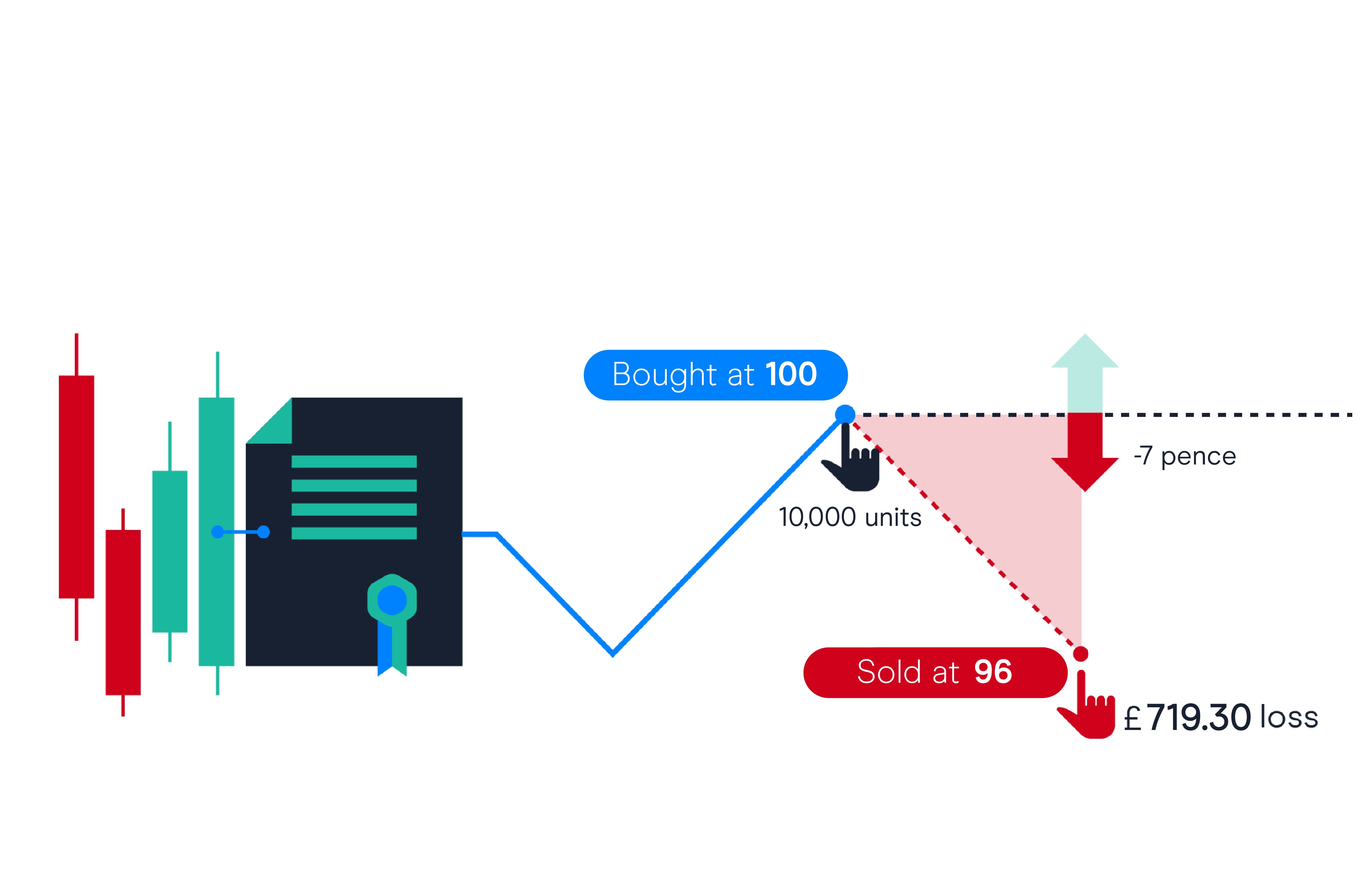

CFD trading involves a high level of risk due to leverage. While leverage can amplify profits, it also magnifies losses. Even a small adverse price movement can result in significant losses, potentially exceeding your initial investment.

2. Counterparty Risk:

When trading CFDs, you are entering into a contract with your broker. Therefore, there is counterparty risk that your broker may default on its obligations. It’s essential to choose a reputable and regulated broker to mitigate this risk.

3. Volatility and Market Risks:

Financial markets are inherently volatile, and CFDs are no exception. Price fluctuations can occur rapidly, especially during times of economic uncertainty or geopolitical instability, increasing the risk of losses for traders.

4. Overnight Financing Costs:

Holding CFD positions overnight may incur financing costs, also known as overnight fees or swaps. These costs can eat into profits, particularly for longer-term trades, and should be considered when planning your trading strategy.

In conclusion, while CFDs offer traders numerous benefits, including diversification, flexible leverage, and access to global markets, they also carry inherent risks, such as high volatility, leverage-induced losses, and counterparty risk. It’s essential for traders to understand these risks and to trade responsibly, using risk management strategies to protect their capital.