Tag Archives: plans 2021

If you’re over the age of 65 and having Medicare prepare, then you are the correct man to elect for that best Medicare supplement plans 2021. It is also called Medigap policy or plan which is the kind of insurance program and act for a nutritional supplement to your own initial Medicare program. These supplementary plans are required to adhere to the condition and federal legislation designed to safeguard the readers of this policy and it must be identified obviously as Medicare Supplement Insurance Plan. Insurance companies are allowed to offer you only the standardized insurance policy that’s identified with your condition and federal govt.

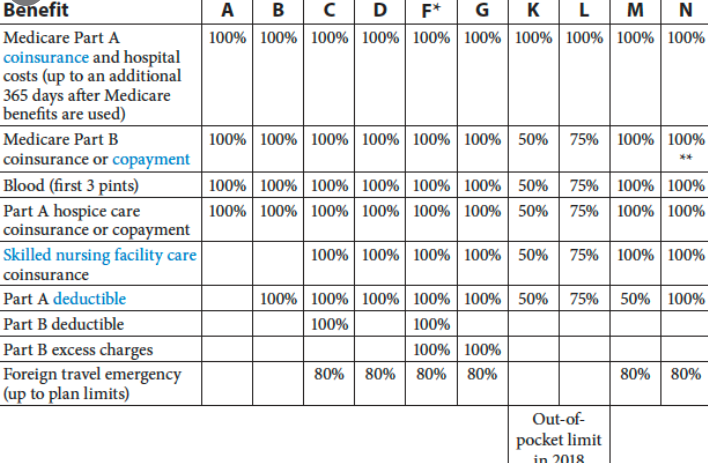

The fundamental Medicare Plans offer you the Exact basic Positive Aspects, except several Additional costs such as co payments, coinsurance and deductibles. So, to pay these costs Medicare Supplement Strategies are all designed and to choose the very best supplement plans, you need to make use of the Medicare Supplement Plans Comparison Chart 2021.

Know More About Your Supplement Ideas

It is up to this Insurance Policy Business to Determine that Medicare Complement Plan to view. However, their state law may affect which person that they mean to offer. The insurance companies that are selling the Medicare Supplement Options:

• Must provide Part A Medicare Prepare should additionally they Provide any Medicare Coverage

• Do not need to offer all the Medicare Program

• Must offer Approach C and Plan F if they are offering other Medicare Guidelines

Before Picking any of the programs, It’s Crucial That You compare with the Policies and plans alongside using the contrast chart. The comparison chart of how Medicare Supplement ideas shows that you that the basic info, benefits and charges which can be insured by each nutritional supplement program. The majority of the nutritional supplements insure 100 percent of rewards and offer coverage for several of the out of the pocket charges which aren’t covered under the Original Medicare program.

When Some body is going to retirewith other worrisome thoughts one of those most ordinary things that can consume you will be that Medicare approach you ought to consider to take. It can feel like a big burden for you to consider when is the full time for you to register in Medicare.

The Scariest assumed are the one at which you must pick in which Medicare plan you will enrol . Inside this informative article, we will talk about the essential information you ought to know about Medicare. You can always choose to choose Medicare supplement plans 2021instead.

Medicare Isn’t Going to be budget-friendly

Know That the Medicare plan is broken up into some pieces. There are Portion A, Part B, Part D, Medicare benefits, Medigap, etc..

Each of These parts cover different portions of the strategy. An individual might be since the healthcare facility services, still another can cover doctor visits, even while one will take care of the breaking of these drugs.

These Will take a certain amount of funding and you also need to keep this in your mind until you just retire.

You Can Select the one with greatest Benefits or all

Now you Have the option to choose the traditional Medicare plan. It Features Section A, B, D, and a Medigap Coverage. You could even decide to take Medicare edge as an alternative.

Abundant ones Need to Pay longer

In case You are loaded with dollars, you may have to cover more than others. As an example- by taking a traditional Medicare approach, you may need to cover more on pieces B and D.

Know if to register up

People With social safety advantages have previously entitled to purchase areas A and B. Those with no societal security, they have to register to parts A and B.

Free of Charge Medicare benefits

Even the Borrowers are eligible to get many free Medicare positive aspects, including as for example screening process of cardio vascular illness, pneumonia, and influenza shots, annual totally free health visits in doctors, etc..

Exactly what is not going to be coated with The Medicare plan?

Even the Original strategy will cover basic health care. But it will not cover the lengthy term. Even if you require it seriously.

Medicare Advantage options are insurance coverage which cover the expenses and charges falling under the medical terms. Old individuals usually go through a challenging period due to illness and diseases. Moreover, because they aren’t qualified to do some physical work, it is burdensome for them to afford the treatments and medical care. Consequently, Humana Medicare Advantage plans 2021 addresses all needs and necessities of the older while being more palatable.

Find out about Humana Medicare Advantage Plans 2021

Medicare plans ‘ve always been very beneficial for the older. They cover the majority of medical costs and expenditures such as doctor visits, drugs, therapies, and operations. The typical medical expenses of a aged person when counted annually sum up to very significant volume. Lots of men and women find it impossible to afford to pay this kind of costly fee for medical and treatment care. Consequently, Humana Medicare Advantage plans 2021 provides enhanced services and facilities in comparison with the earlier Medicare benefit programs.

Who can sign up to Humana Medicare Advantage Plans 2021?

Any older individual or Couple who has attained the age of 65 years may register to your plan. Furthermore, private insurance businesses provide doorstep registering up services to the elderly to create the job hassle-free and convenient to their own.

The Humana Medicare Advantage Plans 2021 includes huge benefits and handles all healthcare expenses and bills of the elderly. They ought to enroll in the plan and relish the benefits of the same.